Over the last 48 hours there has been quite a buzz on Twitter, Facebook and on various left-ish blogs about a new campaign (campaign site here) in the UK for a so-called Robin Hood Tax. What the hell is a Robin Hood Tax was my first thought? Unlike income tax or value added tax, the name is clearly chosen for branding purposes.

It turns out that the idea is essentially the Tobin Tax (or a Financial Transaction Tax) that would take an average of 0.05% from speculative banking transactions.

So why, with much fanfare and the backing of an impressive range of organisations, are we calling this thing the Robin Hood Tax rather than Tobin Tax or Financial Transaction Tax?

Essentially the idea is that Robin Hood took from the rich and gave to the poor, and that’s what this tax is designed to do. But isn’t that the idea behind a whole range of taxes, not least income tax?

Secondly, the Tobin Tax notion is – at least among political activists – known across the world. Is there going to be an attempt to apply the Robin Hood name to it elsewhere as well? And to do so, does everyone outside the UK know enough of the Robin Hood story? Robin Hood has at least been used to refer to financial plans before – in 1993 in Texas. Or has this naming idea been cooked up by UK activists just conscious of the UK general election on the horizon?

Maybe I am too much of a political nerd, but I am only in favour of catchy titles for things if it actually helps the population understand what’s going on, and in this case – while the frame is nice and fuzzy and positive and pleasant – that’s not so. Many taxes are Robin Hood-style, from rich to poor, so the new title does not assist citizen understanding. For me Financial Transaction Tax is just clearer and simpler, and Tobin Tax as a title at least credits the Nobel Prize winning economist who came up with the idea

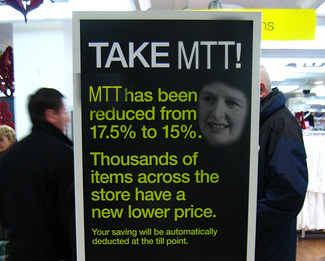

Last but not least, what might we call taxes that redistribute the other way, i.e. from poor to rich? Value Added Tax is the most obvious example of this, so can we call that the Margaret Thatcher Tax and levy 17.5% MTT in the UK from now on?

Unfortunately, Jon, isn’t the EU the author of VAT?

Maybe Robin Hood Tax is the right name for it, if we think back to what Robin Hood did:

The country needed to raise money to pay for the ransom of King Richard, the peasants were taxed and then Robin stole the money back so the peasants had to be taxed harsher in order to still pay the ransom.

Now if we look at the current situation country needed to raise money to pay for the banks to do their very important work, like Robin Hood the Government wants to steal back some of the money they have given to the banks, which will then require the banks to ask for more money.

In concluding both Robin Hood and the Robin Hood Tax might seem popular but they both have little if any benefit.

I agree Robin Hood tax is not a good name for this tax on financial transactions. Not only because the prime and foremost example of a Robin Hood Tax is of course income tax. But also because I doubt this financial transactions tax in reality has the Robin Hood effect attributed by its proponents: After all many of those transactions are done by pension funds trying to secure pension payments in the long run. And the inevitable result of higher transaction costs in the financial sector is a Margaret Thatcher effect on the costs bank customers pay for a bank account. Cynics might even say that at least in part the costs of current government interventions in the banking sector are income dependent, because they are paid for with tax money.

This is not to say that there is no need to curb risk-promoting incentives or moral hazard in the financial sector, on the contrary. But it is better to reduce those by targetting them directly, e.g. to make excessive risk-taking more expensive by increasing the costs of leverage (increasing capital requirement ratios), or to reduce moral hazard by making sure that failing bankers (and failing banks) pay for the costs they cause to society. Not by bluntly reducing the efficiency of the entire sector by putting a charge on all transactions, whatever their actual effect on the stability of the sector.

I bet it’s way easier to sell a “Robin Hood Tax” (because everybody can guess what it does) than a “Tobin tax”

But I’m with David : Tobin Hood seems like a good compromise.

Precisely my thoughts, but if it helps to popularise the idea of a Financial Transaction Tax in the UK, why not?

Tobin Hood Tax? as compromise 😉