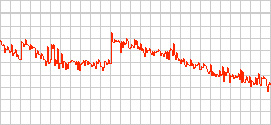

I don’t know enough about economics to comment on practicalities of the current economic turmoil, but I want to instead reflect on the way the media – especially in the UK and USA – needs to change its vocabulary when reporting on what is going on. Take today’s BBC News article ‘Global shares keep on tumbling‘. It contains this passage:

I don’t know enough about economics to comment on practicalities of the current economic turmoil, but I want to instead reflect on the way the media – especially in the UK and USA – needs to change its vocabulary when reporting on what is going on. Take today’s BBC News article ‘Global shares keep on tumbling‘. It contains this passage:

Global falls have largely wiped out the gains earlier in the week, as fears of recession cancelled out any optimism from government bank rescue packages.

The credit crunch is at the root of the problems facing the UK and USA, and that’s been created by financial institutions. OK, high energy and food prices would have helped contribute to a global slowdown but not to the same extent. Banks are helping to self-sustain a slowdown, but you would not gather that from the way it’s reported. Banks in the UK are even whining that they cannot pay dividends to their shareholders if they accept some of the British government’s bail out funds. Not even The Guardian is critical. Do journalists see that the current environment it’s not business as usual?

Outside the UK a USA Today article states:

Investors are worried. They’re anxious. Their heads are spinning from too many unanswered questions related to their financial security. Why is this happening? Why can’t the government fix things? Why can’t stocks mount a rebound — even for a day? Why is it that the Dow can drop almost 700 points in a matter of minutes?

Well, sorry, governments all over have done what they can to fix things. But why can’t the banks themselves find partial ways out of the mess they have landed us all in? Why have banks put us in this predicament?

In short we have our discourse completely wrong in the media about all of this. Financial institutions are the root cause of the problems our economies are facing currently, yet all of our journalists are so stuck in the groove that it’s financial institutions good, government bad. We need a new discourse to describe what is going on, and stating where blame is due.

Jon,

Another angle is inadequate structures for crisis prevention and crisis management at European level, for the ones who want to think about the potentials of public sector action, as I have tried to illustrate on my blog.

Intersting take on this, but I think this is about fear and trust, and the 24-hour media has a key role in all this because it thrives on the former and can undermine the latter.

Are statments like the one you highlighted re cancelling out optimism on global financial packages effectively fuelling the very fears they describe? Is it just a case of digging and digging to see what happens next?

As Terry Pratchett put it in ‘Interesting Times`: “Probably the last sound heard before the Universe folded up like a paper hat would be someone saying, ‘What happens if I do this?'”

best coverage I’ve seen (heard, to be more precise) is on This American Life and NPR’s new Planet Money podcast.

More here:

http://jackthurston.com/so-you-think-you-understand-the-credit-crunch/2008/09/19/